Friday, February 26, 2010

Market Review 2/26/10

Euro implied volatility smile

VIX and CDS on Greece

Thursday, February 25, 2010

First Week

Market Review 2/25/10

Wednesday, February 24, 2010

Market Update 2/24/10

Over the past 2 weeks VIX and VIX futures came down significantly. VIX call options lost value over this time period.

For example the 25 March VIX call options were trading at $3 on Feb 8. Today they closed at $0.6.

Here are the factors driving the price change:

-the March VIX futures went down from 26.2 to 21.7 today. This caused a loss of $2.3 in the price of the VIX call options

-options loose value over time, this option lost about $0.6 over this time period

-the option gained about $0.5 due to the increase in the implied volatility (from 73% to 88%). This is something unique to VIX options as I mentioned in my prior post, the IV goes up as they get closer to expiration. It is interesting how this reduces the cost of carry (theta) of these options.

If you add these up you get to the price difference of $2.4.

In case you were shorting this monster you are a happy guy.

Introduction to VIX options (Part 1)

One of my goals with this blog is to explore the VIX options, which are one of the most complex instruments available for individual investors.

Volatility is certainly a fascinating subject. Imagine a formula for gauging human emotion – what could be more interesting than that?

Implied volatility of VIX options is the second derivative of the price of the S&P 500. Unless you like math, it gives you a headache just thinking about it.

Even CBOE admits “calculating exact theoretical values for VIX options can be very complex”.

Why is so complex?

First reason:

CBOE decided to base the price of VIX options not on the current level of the VIX, but on the anticipated level of the VIX at expiration. The price of any index option depends on the forward price of the index and the expected shape of the forward price distribution. Forward prices of option volatility exhibit a "term structure", meaning that the prices of options expiring on different dates may imply different volatility estimates.

VIX options investors look at the prices of the VIX futures to gain a better general idea of how the market is estimating the forward value of VIX.

As I mentioned before on average the VIX term structure is upward sloping, probably due to investor demand for volatility hedging.

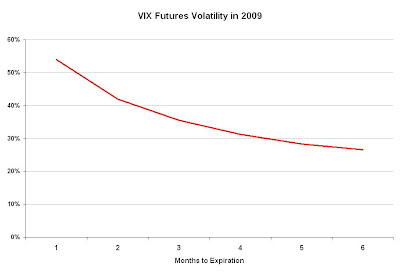

Historically, VIX futures have tended to be less volatile, on average, than the VIX index itself. The volatility is lower for longer dated futures.

This means that as they get closer to expiration the VIX options implied volatility is increasing.

This means that as they get closer to expiration the VIX options implied volatility is increasing.In option language this means that if you hold a VIX option you lose money due to theta but you make money due to higher implied volatility as you get closer to expiration.

To be continued….

Tuesday, February 23, 2010

Market Update 2/23/10

Stocks pulled back today, SPY lost 1.2%, HYG lost 0.7%.

VIX spot is up 1.4% points to 21.37%.

The VIX futures term structure flattened today:

Even with this up move the VIX is still lower than the average for the past month.

Even with this up move the VIX is still lower than the average for the past month.Monday, February 22, 2010

Market Update 2/22/10

VXX and the term structure of VIX

If you look at the median VIX term structure since 1992, you can clearly see that over the long run the VIX futures are in contango:

For example you can use VXX to delta hedge your short VIX call options position. If you short the first and second month VIX call options VXX can be a usefull tool to delta hedge your portfolio.

Let me know your thoughts.

VIX Fair Value Model

The CBOE website has the historical VIX term structure.

As I mentioned before there is a strong relationship between high yield OAS and VIX.

Here is the model vs. the actual near-term+6 VIX:

So, what is this model telling us today?

As you can see this is the Dec VIX fair value, the VIX spot and the near term is a lot more volatile.

I'm working on a model to come up with a fair value for the shorter term VIX as well.

Let me know you thoughts.

Friday, February 19, 2010

First Trade Idea

Short 4 April 20 Vix Put option for $70

Short 2 April 30 Vix Call option for $130

Long 2 March 50 Vix Call option fro $10 (will buy 2 April 50 Calls after the March expiration)

Expected Net Credit: $70*4+$130*2-$10*2*2=$500

Max loss $3,500 {2*(50-30)*100-500}

Market Update 2/19/10

VIX and OAS

Introduction to VIX, VIX Futures, and VIX options

It is considered one of the best barometers of investor sentiment and market volatility.

History

• 1993 - The VIX Index is introduced in a paper by Professor Robert E. Whaley of Duke University.

• 2004 - On March 26, 2004, the first-ever trading in futures on the VIX Index began on the CBOE Futures Exchange (CFE).

• 2006 - VIX options were launched in February 2006

Vix Options

VIX options are the first exchange-traded options that give individual investors the ability to trade market volatility. Trading VIX options can be a useful tool for investors wanting to hedge their portfolios against sudden market declines, as well as to speculate on future moves in volatility.

For experienced traders VIX options can be used for volatility arbitrage.