First I want to mention that I’m honored to be included among Bill Luby’s (Vixandmore) favorite option blogs. Bill is one of the top option bloggers.

One of my goals with this blog is to explore the VIX options, which are one of the most complex instruments available for individual investors.

Volatility is certainly a fascinating subject. Imagine a formula for gauging human emotion – what could be more interesting than that?

Implied volatility of VIX options is the second derivative of the price of the S&P 500. Unless you like math, it gives you a headache just thinking about it.

Even CBOE admits “calculating exact theoretical values for VIX options can be very complex”.

Why is so complex?

First reason:

CBOE decided to base the price of VIX options not on the current level of the VIX, but on the anticipated level of the VIX at expiration. The price of any index option depends on the forward price of the index and the expected shape of the forward price distribution. Forward prices of option volatility exhibit a "term structure", meaning that the prices of options expiring on different dates may imply different volatility estimates.

VIX options investors look at the prices of the VIX futures to gain a better general idea of how the market is estimating the forward value of VIX.

As I mentioned before on average the VIX term structure is upward sloping, probably due to investor demand for volatility hedging.

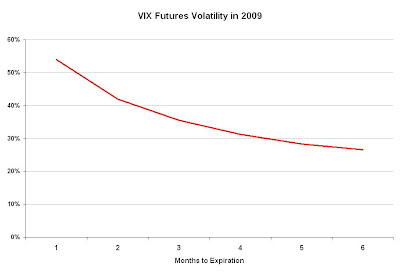

Historically, VIX futures have tended to be less volatile, on average, than the VIX index itself. The volatility is lower for longer dated futures.

This means that as they get closer to expiration the VIX options implied volatility is increasing.

This means that as they get closer to expiration the VIX options implied volatility is increasing.

In option language this means that if you hold a VIX option you lose money due to theta but you make money due to higher implied volatility as you get closer to expiration.

To be continued….

One of my goals with this blog is to explore the VIX options, which are one of the most complex instruments available for individual investors.

Volatility is certainly a fascinating subject. Imagine a formula for gauging human emotion – what could be more interesting than that?

Implied volatility of VIX options is the second derivative of the price of the S&P 500. Unless you like math, it gives you a headache just thinking about it.

Even CBOE admits “calculating exact theoretical values for VIX options can be very complex”.

Why is so complex?

First reason:

CBOE decided to base the price of VIX options not on the current level of the VIX, but on the anticipated level of the VIX at expiration. The price of any index option depends on the forward price of the index and the expected shape of the forward price distribution. Forward prices of option volatility exhibit a "term structure", meaning that the prices of options expiring on different dates may imply different volatility estimates.

VIX options investors look at the prices of the VIX futures to gain a better general idea of how the market is estimating the forward value of VIX.

As I mentioned before on average the VIX term structure is upward sloping, probably due to investor demand for volatility hedging.

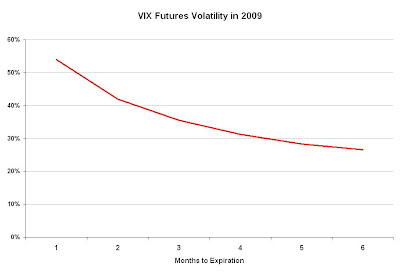

Historically, VIX futures have tended to be less volatile, on average, than the VIX index itself. The volatility is lower for longer dated futures.

This means that as they get closer to expiration the VIX options implied volatility is increasing.

This means that as they get closer to expiration the VIX options implied volatility is increasing.In option language this means that if you hold a VIX option you lose money due to theta but you make money due to higher implied volatility as you get closer to expiration.

To be continued….

Hi Robert, My impression is that the CBOE based the VIX options on the anticipated value at expiration because VIX futures were the only viable underlying for the option market makers to use. If there was a way for market makers to offer vix options that tracked the current value of the VIX I think somebody would be all over it--given the success of the seriously lagging VXX and current VIX option choices. Comments?

ReplyDelete